UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 90549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under Rule 14a-12 |

ADVAXIS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transactions applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction. | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials: | ||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Advaxis, Inc.

305 College Road East

Princeton, New Jersey 08540

Dear Stockholder:

You are cordially invited to our 2018 Annual Meeting of Stockholders, to be held at 10:00 a.m. Eastern time, on March 21, 2018, at the offices of our legal counsel, Alston & Bird LLP, located at 90 Park Avenue, New York, New York 10016. At the meeting, stockholders will be asked to (i) elect five directors for a term of one year, (ii) approve an amendment to our Amended and Restated Certificate of Incorporation to increase our authorized share capital by 30,000,000 shares of common stock, (iii) approve our 2018 Employee Stock Purchase Plan, and (iv) ratify the appointment of Marcum LLP as our independent registered public accounting firm for the year ending October 31, 2018. You will also have the opportunity to ask questions and make comments at the meeting.

In accordance with the rules and regulations of the Securities and Exchange Commission, we are furnishing our proxy statement and annual report to stockholders for the year ended October 31, 2017 on the Internet. You may have already received our “Important Notice Regarding the Availability of Proxy Materials,” which was mailed on or about February 6, 2018. That notice described how you can obtain our proxy statement and annual report. You can also receive paper copies of our proxy statement and annual report upon request.

It is important that your stock be represented at the meeting regardless of the number of shares you hold. You are encouraged to specify your voting preferences by marking our proxy card and returning it as directed. If you do attend the meeting and wish to vote in person, you may revoke your proxy at the meeting.

If you have any questions about the proxy statement or the accompanying 2017 Annual Report, please contact Sara M. Bonstein, our Chief Financial Officer and Corporate Secretary at (609) 250-7510.

We look forward to seeing you at the 2018 Annual Meeting.

Sincerely,

| |

February 6, 2018Princeton, New Jersey

Advaxis, Inc.305 College Road EastPrinceton, New Jersey 08540

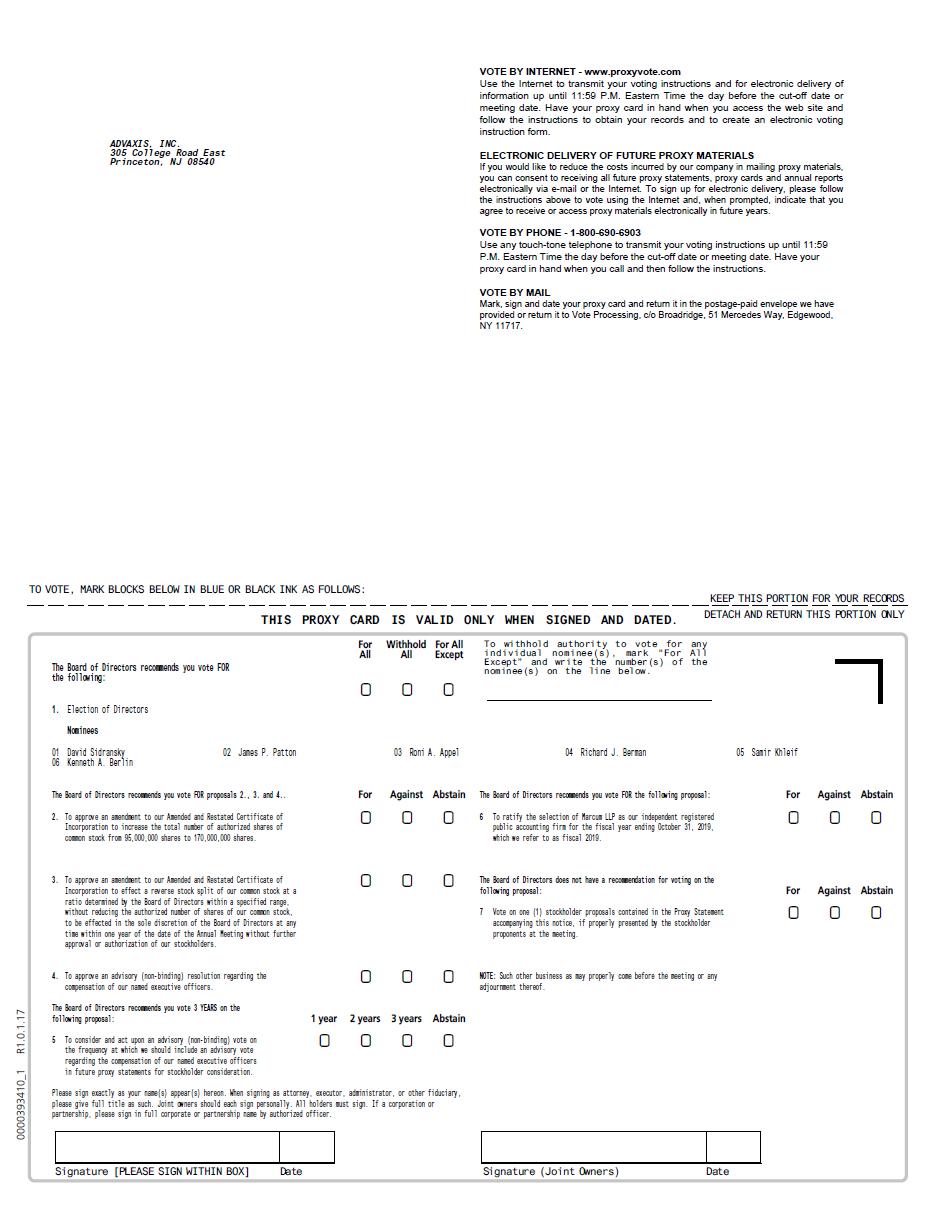

NOTICE OF 20182019 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that the 20182019 Annual Meeting of Stockholders of Advaxis, Inc. will be held at the offices of Alston & BirdGoodwin Procter LLP, our legal counsel, located at 90 ParkThe New York Times Building, 620 Eighth Avenue, New York, New York 10016,10018, on MarchFebruary 21, 2018,2019, at 10:00 a.m., Eastern Time, to consider and act upon the following:

| 1. | To elect |

| 2. | To approve an amendment to our Amended and Restated Certificate of Incorporation to increase |

| 3. | To approve an amendment to our |

| 4. | To approve an advisory (non-binding) resolution regarding the compensation of our named executive officers. |

| 5. | To consider and act upon an advisory (non-binding) vote on the frequency at which we should include an advisory vote regarding the compensation of our named executive officers in future Proxy Statements for stockholder consideration. |

| 6. | To ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending October 31, |

| Vote on one (1) stockholder proposal contained in the Proxy Statement accompanying this notice, if properly presented by the stockholder proponents at the meeting. | |

| 8. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Our proxy statementProxy Statement and annual report to stockholders for the year ended October 31, 20172018 can also be viewed online by following the instructions listed on our proxy card.

Instructions on how to vote your shares via the Internet are contained on the “Important Notice Regarding the Availability of Proxy Materials,” which wasis expected to be mailed on or about February 6, 2018.January 15, 2019. Instructions on how to obtain a paper copy of our proxy statementProxy Statement and annual report to stockholders for the year ended October 31, 20172018 are listed on the “Important Notice Regarding the Availability of Proxy Materials.” These materials can also be viewed online by following the instructions listed on the “Important Notice Regarding the Availability of Proxy Materials.”

If you choose to receive a paper copy of our proxy statementProxy Statement and annual report, you may vote your shares by completing and returning the proxy card that will be enclosed.

Holders of record of the Company’s common stock at the close of business on January 19,December 26, 2018 are entitled to receive notice of, and to vote at, the Annual Meeting. The date of mailing of this Notice of our 20182019 Annual Meeting of Stockholders and the accompanying Proxy Statement and materials is expected to be on or about February 6, 2018.January 15, 2019.

All stockholders are cordially invited to attend the Annual Meeting.

| By Order of the Board of Directors, | |

| |

Kenneth A. Berlin | |

President and Chief |

February 6, 2018

Princeton, New Jersey

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCHFEBRUARY 21, 2018.2019.

THE PROXY STATEMENT AND ANNUAL REPORT ON FORM 10-K FOR

THE FISCAL YEAR ENDED OCTOBER 31, 20172018 ARE AVAILABLE AT HTTP:HTTPS://IR.ADVAXIS.COM/FINANCIAL - INFORMATION/SEC - FILINGSWWW.PROXYVOTE.COM

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING AND IN

ORDER TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL

MEETING, PLEASE SIGN AND RETURN THE ENCLOSED PROXY CARD

AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.

ADVAXIS, INC.

TABLE OF CONTENTS

Advaxis, Inc.

305 College Road East

Princeton, New Jersey 08540

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCHFEBRUARY 21, 20182019

This proxy statement is being made available via Internet access, beginning on or about February 6, 2018,January 11, 2019, to the owners of shares of common stock of Advaxis, Inc. (the “Company,” “our,” “we,” or “Advaxis”) as of January 19,December 26, 2018, in connection with the solicitation of proxies by our Board of Directors (the “Board”) for our 20172019 Annual Meeting of Stockholders (the “Annual Meeting”). On or about February 6, 2018,January 15, 2019, we sentexpect to send an “Important Notice Regarding the Availability of Proxy Materials” to our stockholders. If you received this notice by mail in prior years, you will not automatically receive by mail our proxy statementProxy Statement and annual report to stockholders for the year ended October 31, 2017.2018. If you would like to receive a printed copy of our proxy statement,Proxy Statement, annual report and proxy card, please follow the instructions for requesting such materials in the notice. Upon request, we will promptly mail you paper copies of such materials free of charge.

INFORMATION ABOUT THE ANNUAL MEETING

Why did I receive an “Important Notice Regarding the Availability of Proxy Materials”?

In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials, we may send an “Important Notice Regarding the Availability of Proxy Materials” to stockholders. All stockholders will have the ability to access the proxy materials on a website referred to in the notice or to request a printed set of these materials at no charge. You will not receive a printed copy of the proxy materials unless you specifically request one from us. Instead, the notice instructs you as to how you may access and review all of the important information contained in the proxy materials via the Internet and submit your vote via the Internet.

When is the Annual Meeting?

The Annual Meeting will be held at 10:00 a.m., Eastern Time, on MarchFebruary 21, 2018.2019.

Where will the Annual Meeting be held?

The Annual Meeting will be held at the offices of Alston & BirdGoodwin Procter LLP, our legal counsel, located at 90 ParkThe New York Times Building, 26th Floor, 620 Eighth Avenue, New York, New York 10016.10018.

What items will be voted on at the Annual Meeting?

There are fourseven matters scheduled for a vote:

| ● | To elect | |

| ● | To approve an amendment to our Amended and Restated Certificate of Incorporation to increase | |

| ● | To approve an amendment to our | |

| ● | To approve an advisory (non-binding) resolution regarding the compensation of our names executive officers (“Proposal No. 4”); | |

| ● | To consider and act upon an advisory (non-binding) vote on the frequency at which we should include an advisory vote regarding the compensation of our named executive officers in future Proxy Statements for stockholder consideration (“Proposal No. 5”); | |

| ● | To ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending October 31, | |

| ● | Vote on one (1) stockholder proposal contained in the Proxy Statement accompanying this notice, if properly presented by the stockholder proponents at the meeting (“Proposal No. 7”). |

As of the date of this proxy statement,Proxy Statement, we are not aware of any other matters that will be presented for consideration at the Annual Meeting.

What are the Board of Directors’ recommendations?

Our Board recommends that you vote:

| ● | “FOR” the election of each of the | |

| ● | “FOR” the approval of an amendment to our Amended and Restated Certificate of Incorporation to increase our authorized | |

| ● | “FOR” the approval of an amendment to our | |

| ● | “FOR” the advisory vote on the compensation of the named Executive Officers as described in this proxy statement; | |

| ● | “FOR” a three-year frequency for inclusion of an advisory vote regarding the compensation of named executive officers in future proxy statements for stock holder consideration; | |

| ● | “FOR” the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for fiscal | |

| ● | The Board, after careful consideration, is not making a recommendation either in favor of or opposed to the stockholder proposal regarding the institution of a director election majority vote standard. |

INFORMATION ABOUT THE VOTING

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on January 19, 2018,December 26,2018, which we refer to as the Record Date, are entitled to receive notice of the Annual Meeting and to vote the shares that they held on that date at the Annual Meeting, or any adjournment or postponement thereof. As of the close of business on the Record Date, we had 41,542,69169,619,886 shares of common stock outstanding. Each share of common stock entitles its holder to one vote at the Annual Meeting.

| ● | Stockholders of Record: Shares Registered in Your Name. If on the Record Date your shares were registered directly in your name with our transfer agent, Continental Transfer and Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card, to ensure your vote is counted. | |

| ● | Beneficial Owner: Shares Registered in the Name of a Broker, Bank, Custodian or Other Nominee. If on the Record Date your shares were held in an account at a brokerage firm, bank, custodian or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, custodian or other nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank, custodian or other nominee. |

What constitutes a quorum at the Annual Meeting?

In accordance with Delaware law (the law under which we are incorporated) and our Amended and Restated Bylaws, the presence at the Annual Meeting, by proxy or in person, of the holders of at least one-third of the shares of our common stock outstanding on the record date constitutes a quorum, thereby permitting the stockholders to conduct business at the Annual Meeting. Abstentions, votes withheld, and broker non-votes will be included in the calculation of the number of shares considered present at the Annual Meeting for purposes of determining the existence of a quorum.

If a quorum is not present at the Annual Meeting, a majority in voting interest of the stockholders present in person and by proxy may adjourn the meeting to another date. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting by our Board of Directors, we will provide notice of the adjourned meeting to each stockholder of record entitled to vote at the adjourned meeting. At any adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the originally called meeting.

What is a proxy?

A proxy is a person you appoint to vote your shares of our common stock on your behalf. If you are unable to attend the Annual Meeting, our Board of Directors is seeking your appointment of a proxy so that your shares of our common stock may be voted. If you vote by proxy, you will be designating Anthony A. LombardoKenneth Berlin or Sara M. Bonstein,Molly Henderson, as your proxies. Mr. LombardoBerlin or Ms. BonsteinHenderson may act on your behalf and have the authority to appoint a substitute to act as your proxy.

How do I vote?

Whether you hold shares directly as the stockholder of record or indirectly as the beneficial owner of shares held for you by a broker or other nominee (i.e., in “street name”), you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares you hold in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this by internet, telephone or by mail. Please refer to the summary instructions below and those included on your proxy card or, for shares you hold in street name, the voting instruction card provided by your broker or nominee.

| ● | By Internet — If you have Internet access, you may authorize your proxy from any location in the world as directed in our “Important Notice Regarding the Availability of Proxy Materials.” | |

| ● | By Telephone — If you are calling from the United States or Canada, you may authorize your proxy by following the “By Telephone” instructions on the proxy card or, if applicable, the telephone voting instructions that may be described on the voting instruction card sent to you by your broker or nominee. | |

| ● | By Mail — You may authorize your proxy by signing your proxy card and mailing it in the enclosed, postage-prepaid and addressed envelope. For shares you hold in street name, you may sign the voting instruction card included by your broker or nominee and mail it in the envelope provided. |

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

Can I change my vote after I return my proxy card?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| ● | You may submit another properly completed proxy bearing a later date; | |

| ● | You may send a written notice that you are revoking your proxy to Advaxis, Inc. at 305 College Road East, Princeton, New Jersey 08540, Attention: | |

| ● | You may attend the Annual Meeting and notify the election officials at the Annual Meeting that you wish to revoke your proxy and vote in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker, bank, custodian or other nominee, you should follow the instructions provided by such broker, bank, custodian or other nominee.

What if I sign and return my proxy but do not provide voting instructions?

Proxy cards or voting instruction cards that are signed, dated and returned but do not contain voting instructions will be voted:

| ● | “FOR” the election of each of the | |

| ● | “FOR” the approval of an amendment to our Amended and Restated Certificate of Incorporation to increase our authorized | |

| ● | “FOR” the approval of an amendment to our | |

| ● | “FOR” an advisory vote on the compensation of the named Executive Officers as described in this Proxy Statement; | |

| ● | “FOR” a three-year frequency for inclusion of an advisory vote regarding the compensation of named executive officers in future proxy statements for stock holder consideration; | |

| ● | “FOR” the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for fiscal | |

| ● | “ABSTAIN”on the stockholder proposal regarding the institution of a director election majority vote standard, if properly presented at the Annual Meeting. |

| 4 |

How are votes counted?

Before the Annual Meeting, our Board of Directors will appoint one or more inspectors of election for the meeting. The inspector(s) will determine the number of shares represented at the meeting, the existence of a quorum and the validity and effect of proxies. The inspector(s) will also receive, count, and tabulate ballots and votes and determine the results of the voting on each matter that comes before the Annual Meeting. Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the New YorkNasdaq Stock Exchange (the “NYSE”) which govern voting matters at the Annual Meeting, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner.

Under NYSENasdaq rules the following matters are considered to be “routine” matters: (i) the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of increasing the authorized number of shares; (ii) the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of granting the Board of Directors authority to effect a reverse stock split and (iii) the ratification of Marcum LLP as our independent registered public accounting firm for the year ending October 31, 2018 and (ii) the approval of an amendment to our Amended and Restated Certificate of Incorporation to increase our authorized common stock by 30,000,000 shares.2018. Brokers that hold your shares therefore have discretionary authority to vote your shares without receiving instructions from you on such matters.

What vote is requiredHow many votes are needed to elect our directors for a one-year term?approve each proposal?

The affirmative vote of a plurality of the votes of the shares present, in person or by proxy, at the Annual Meeting is required for the election of each of the nominees for director. “Plurality” means that the nominees receiving the largest number of votes up to the number of directors to be elected at the Annual Meeting will be duly elected as directors. Votes withheld, and broker non-votes will not affect the outcome of director elections.

| ● | For the election of directors (Proposal No. 1), the six nominees receiving the most “FOR” votes (among votes properly cast in person or by proxy) will be elected. Only votes “FOR” or votes withheld with respect to any or all of the nominees will affect the outcome. Abstentions and broker non-votes will have no effect on the outcome of the election of directors. | |

| ● | For the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of increasing the authorized number of shares (Proposal No. 2), the approval of the amendment to the Advaxis, Inc. Amended and Restated Certificate of Incorporation for the purpose of granting the Board of Directors authority to effect a reverse stock split (Proposal No. 3), the proposal must receive a majority of the total number of shares of our common stock outstanding on the record date. Abstentions and broker non-votes with respect to these proposals will be counted for purposes of establishing a quorum and, if a quorum is present, broker non-votes shall be counted as votes for these proposals, while abstentions will have the same practical effect as a voteagainstthese proposals. | |

| ● | To be approved, Proposal No. 4 (the “say-on-pay” advisory proposal), Proposal No. 5 (frequency of the “say-on-pay” proposal), Proposal No. 6 (the ratification of the appointment of Marcum LLP as our independent registered public accounting firm for fiscal 2019) and Proposal 7 (the proposed stockholder proposal on majority voting) must receive “FOR” votes from the holders of a majority of the shares present, in person or by proxy, and entitled to vote. Abstentions and broker non-votes with respect to these proposals will be counted for purposes of establishing a quorum. If a quorum is present, broker non-votes will not affect the outcome of the votes on Proposals 4, 5 and 7 and will be counted as votes for Proposal No. 6. Abstentions shall have the same practical effect as a voteagainst these proposals. |

What vote is required to ratify Marcum LLP as our independent registered public accounting firm for the year ending October 31, 2018?

The affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting is required to approve the ratification of Marcum LLP as our independent registered public accounting firm for the year ending October 31, 2018. Abstentions will have the same effect as a negative vote. However, broker non-votes, if any, as this is a “routine” matter under NYSE rules, will not have the effect of a vote against this proposal as they are not considered to be present and entitled to vote on this matter and, therefore, have no effect on the result of this vote (see “How are Votes Counted?” above).

What vote is required to approve an amendment to our Certificate of Incorporation to increase our authorized common stock by 30,000,000 shares?

The affirmative vote of a majority of our common stock outstanding is required to approve the amendment to our Certificate of Incorporation to increase our authorized common stock by 30,000,000 shares. The effect of an abstention or a broker non-vote, if any, as this is a “routine” matter under NYSE rules, is the same as that of a vote against the proposal (see “How are Votes Counted?” above).

What vote is required to approve our 2018 Employee Stock Purchase Plan?

The affirmative vote of a majority of the shares present, in person or by proxy, and entitled to vote at the Annual Meeting is required to approve our 2018 Employee Stock Purchase Plan.Abstentions will have the same effect as a negative vote.

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Form 8-K filed with the SEC, within four business days after the Annual Meeting.

How do I obtain a list of the Company’s stockholders?

A list of our stockholders as of the Record Date will be available for inspection at our corporate headquarters located at 305 College Road East, Princeton, New Jersey 08540 during normal business hours during the 10-day period prior to the Annual Meeting.

Who is paying for this proxy solicitation?

We will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials and soliciting votes. If you choose to vote over the internet, you are responsible for internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities. Proxies also may be solicited by employees and our directors by mail, telephone, facsimile, e-mail or in person.

Additional Information

Whom should I contact if I have any questions?

If you have any questions about the Annual Meeting, these proxy materials or your ownership of our common stock, please contact Sara M. Bonstein,Molly Henderson, our Chief Financial Officer and Corporate Secretary, by mail at Advaxis, Inc., 305 College Road East, Princeton, New Jersey 08540, by telephone: (609) 250-7510 or by fax: (609) 452-9818.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

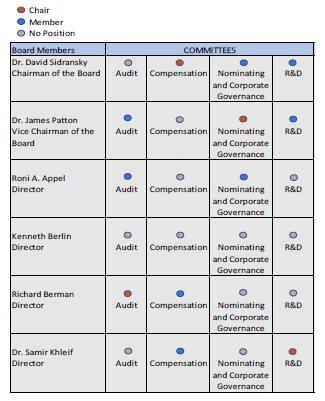

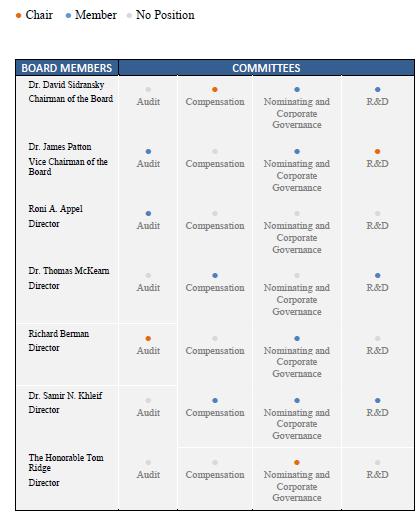

Our By-laws provide that the number of directors is to be no less than one and no more than nine and shall be fixed by action of the directors. Currently, our Board of Directors consists of sevensix members. Governor Ridge and Dr. McKearn will not stand for reelection at our 2018 Annual Meeting of Stockholders. Governor Ridge has chosen to not stand for reelection so as to focus on his health and rehabilitation and Dr. McKearn is pursuing other opportunities. The Company would like to thank both Governor Ridge and Dr. McKearn for their service and contributions. We have proposed five individuals for nomination to our Board. Each director will hold office until the next annual meeting of stockholders and until his successor is duly elected and qualified, or untilsubject to his earlier resignation or removal. For information regarding the independence of our directors, see “Corporate Governance Matters — Director Independence” elsewhere in this proxy statement.Proxy Statement.

Unless otherwise instructed, the persons named in the proxy will vote to elect the fivesix nominees named below as directors. Although the Board does not contemplate that any of the nominees will be unavailable to serve as a director, should any unexpected vacancies occur, the enclosed proxy will be voted for such substituted nominees, if any, as may be designated by the Board. In no event will the proxy be voted for more than fivesix directors.

Information for Nominees for Director

The names of the nominees for election as directors at the Annual Meeting, each of whom is an incumbent director, and certain information about them, including their ages as of January 31, 2018 is set forth below:

| Name | Age | Position | ||

| Dr. David Sidransky | Chairman of our Board of Directors | |||

| Dr. James P. Patton | Vice Chairman of our Board of Directors | |||

| Roni A. Appel | Director | |||

| Kenneth A. Berlin | 54 | President and Chief Executive Officer, Director | ||

| Richard J. Berman | Director | |||

| Dr. Samir N. Khleif | Director |

Biographical information for all nominated directors and current directors is provided in the Corporate Governance Matters section elsewhere in this proxy statement.Proxy Statement.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL NO. 1 RELATING TO ELECTING EACH OF THE FIVE NOMINEES LISTED ABOVE.

| 6 |

PROPOSAL NO. 2

APPROVAL OF an amendment to ourAN AMENDMENT TO OUR AMENDED AND RESTATED Certificate of Incorporation toCERTIFICATE OF INCORPORATION TO INCREASE our authorized shareSTHE TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK by 30,000,000 shares from 65,000,000 toFROM 95,000,000 TO 170,000,000

Overview

Our Amended and Restated Certificate of Incorporation (the “Certificate”) currently authorize us to issue an aggregate of 65,000,00095,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of “blank check” preferred stock, par value $0.001 per share.

Our Board of Directors has approved, and is seeking stockholder approval of, an amendment to our Certificate (the “Amendment”) to increase the number of shares of common stock authorized for issuance by 30,000,00075,000,000 shares, bringing the total number of authorized shares of common stock to 95,000,000170,000,000 shares. The text of the proposed Amendment is attached hereto asExhibit A.

No changes to the Certificate are being proposed with respect to the number of authorized shares of preferred stock. Other than the proposed increase in the number of authorized shares of common stock, the Amendment is not intended to modify the rights of existing stockholders in any material respect. The additional shares of common stock to be authorized pursuant to the Amendment would have rights identical to the currently outstanding common stock of the Company. Our stockholders do not currently have any preemptive or similar rights to subscribe for or purchase any additional shares of common stock that may be issued in the future, and therefore, future issuances of common stock may, depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of the existing stockholders.

The Board of Directors has unanimously determined that the Amendment is advisable and in the best interests of the Company and our stockholders, and recommends that our stockholders approve the Amendment.

Reasons for Increase

The Board of Directors believes that it is prudent to increase the authorized number of shares of common stock in order to maintain a reserve of shares available for immediate issuance to meet business needs, such as a strategic acquisition opportunity or equity offering,offerings, promptly as they arise. The Board of Directors believes that maintaining such a reserve will save time and money in responding to future events requiring the issuance of additional shares of common stock, such as strategic acquisitions or future equity offerings.

All authorized but unissued shares of common stock will be available for issuance from time to time for any proper purpose approved by the Board of Directors (including issuances in connection with issuances to raise capital, effect acquisitions or stock-based employee benefit plans), without further vote of the stockholders, except as required under applicable law or the Nasdaq Marketplace Rules. There are currently no arrangements, agreements or understandings for the issuance of the additional shares of authorized common stock except for issuances in the ordinary course of business. The Board of Directors does not presently intend to seek further stockholder approval of any particular issuance of shares unless such approval is required by law or the Nasdaq Marketplace Rules.

If the Proposed Amendment is approved by the stockholders, it will become effective upon filing and recording of a Certificate of Amendment as required by the Delaware General Corporation Law.

Vote Required

To approve Proposal No. 2, stockholders holding a majority of the outstanding shares of Advaxis common stock must vote FOR Proposal No. 2. “Broker non-votes” shall be counted as votes FOR Proposal No. 2, while abstentions will count as a vote AGAINST Proposal No. 2.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 2 RELATING TO THE AMENDMENT OF OUR AMENDED

AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE OUR

AUTHORIZED SHARES OF COMMON STOCK BY 75,000,000 SHARES

FROM 95,000,000 TO 170,000,000.

| 7 |

PROPOSAL NO. 3

APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO DETERMINED BY THE BOARD OF DIRECTORS WITHIN A SPECIFIED RANGE, WITHOUT REDUCING THE AUTHORIZED NUMBER OF SHARES OF OUR COMMON STOCK, TO BE EFFECTED IN THE SOLE DISCRETION OF THE BOARD OF DIRECTORS AT ANY TIME WITHIN ONE YEAR OF THE DATE OF THE ANNUAL MEETING WITHOUT FURTHER APPROVAL OR AUTHORIZATION OF OUR STOCKHOLDERS

Overview

The Board has adopted a resolution approving and recommending to the Company’s stockholders for their approval a proposal to amend our certificate of incorporation to effect a reverse split of our outstanding shares of common stock within a range of one share of common stock for every ten shares (1-for-10) of common stock to one share of common stock for every twenty-five shares (1-for-25) of common stock, with the exact reverse split ratio to be decided and publicly announced by the Board prior to the effective time of the amendment to our Amended and Restated Certificate of Incorporation to effect the reverse stock split (the “Reverse Stock Split Amendment”). If the stockholders approve this Proposal No. 3, the Board will have the authority to decide, at any time prior to the date of our 2020 Annual Meeting of Stockholders (the “2020 Annual Meeting”), whether to implement the reverse stock split and the precise ratio of the reverse stock split within a range of one-for-ten shares of our common stock to one-for-twenty-five shares of our common stock. If the Board decides to implement the reverse stock split, the reverse stock split will become effective upon the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware.

The Board reserves the right, even after stockholder approval, to abandon or postpone the filing of the Reverse Stock Split Amendment if the Board determines that it is not in the best interests of the Company and the stockholders. If the Reverse Stock Split Amendment is not implemented by the Board prior to the date of the 2020 Annual Meeting, the proposal will be deemed abandoned, without any further effect. In that case, the Board may again seek stockholder approval at a future date for a reverse stock split if it deems a reverse stock split to be advisable at that time.

Reasons for the Reverse Stock Split

The primary reason for the reverse stock split is to allow us to attempt to increase the bid price of our common stock by reducing the number of outstanding shares of our common stock. To continue listing on The Nasdaq Global Market, we must comply with the applicable listing requirements under Nasdaq Marketplace Rules, which requirements include, among others, a minimum bid price of at least $1.00 per share. On December 10, 2018, the closing bid price of our common stock on the Nasdaq Global Market was $0.37. The Board believes that the reverse stock split will enhance the Company’s ability to maintain compliance with the applicable listing requirements under Nasdaq Marketplace Rules.

If we were unable to maintain compliance with the $1.00 minimum bid price requirement and our common stock were delisted from Nasdaq, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the Pink Sheets or the OTC Bulletin Board. An investor would likely find it less convenient to sell, or to obtain accurate quotations in seeking to buy, our common stock on an over-the-counter market, and many investors would likely not buy or sell our common stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our common stock would be subject to SEC rules regarding “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability of investors to trade in our common stock. For these reasons and others, delisting would adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

In addition, among the factors considered by the Board in reaching its decision to recommend the reverse stock split, the Board considered the potential effects of having stock that trades at a low price. Since the brokerage commissions on stock with a low trading price generally represent a higher percentage of the stock price than commissions on higher priced stock, investors in stocks with a low trading price pay transaction costs (commissions, markups, or markdowns) at a higher percentage of their total share value, which may limit the willingness of individual investors and institutions to purchase our common stock.

There will be no change in our authorized shares as a result of the Reverse Stock Split Amendment and therefore, upon effectiveness of the reverse stock split, the number of shares of our common stock that are authorized and unissued will increase relative to the number of issued and outstanding shares. Except as discussed below under the heading “Principal Effects of the Reverse Stock Split,” we currently have no plans, proposals, arrangements or understandings to issue any of our authorized but unissued shares of our common stock. However, it is possible that some of these additional authorized shares could be used in the future for various other purposes without further stockholder approval, except as such approval may be required in particular cases by our certificate of incorporation, applicable law or the rules of any stock exchange or other system on which our securities may then be listed.

Certain Risks Associated with the Reverse Stock Split

Certain risks associated with the implementation of the reverse stock split include, without limitation, the following:

| ● | While the Board believes that a higher share price may help generate investor interest, there can be no assurance that a reverse stock split will result in a share price that will attract institutional investors or investment funds or satisfy the investing guidelines of such investors. | |

| ● | Some investors may view the reverse stock split negatively, and there can be no assurance that the reverse stock split will favorably impact the share price of our common stock or that the reverse stock split will not adversely impact the share price of our common stock. | |

| ● | There can be no assurance that the reverse stock split will increase the share price for our common stock. The reverse stock split also may not result in a permanent increase in the share price, which depends on many factors, including our performance, prospects and other factors that may be unrelated to the number of shares outstanding. | |

| ● | There can be no assurance that we can maintain compliance with the minimum bid price requirement of Nasdaq Listing Rule 5550(a)(2) for our common stock, and there can be no assurance that we will continue to meet the other listing requirements of The Nasdaq Capital Market. | |

| ● | Although the reverse stock split will not, by itself, impact our assets or prospects, if the fair market value per share of the common stock does not increase proportionately to the decrease in the number of shares of common stock outstanding, the Company’s aggregate market value will decrease. | |

| ● | We will have fewer shares that are publicly traded. As a result, the trading liquidity of our Common Stock may decline. | |

| ● | If the maximum 1-for-25 reverse split is authorized and declared, the reverse split would result in holders of fewer than 2,500 shares holding an “odd lot” or less than 100 shares. A securities transaction of 100 or more shares is a “round lot” transaction of shares for securities trading purposes and a transaction of less than 100 shares is an “odd lot” transaction. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. | |

| ● | Because the number of authorized shares of the Company’s common stock will not be reduced proportionately, the reverse stock split will increase the Board’s ability to issue authorized and unissued shares without further stockholder action, the issuance of which would be dilutive to our existing stockholders and may cause a decline in the trading price of our common stock. The Company could also use authorized but unissued and unreserved shares to oppose a hostile takeover attempt or delay or prevent changes in control or changes in or removal of management. We do not currently have any plans, proposals, or arrangements at this time to issue any of the additional authorized shares of common stock realized as a result of a reverse stock split for any future acquisitions or financings or any other purpose. |

Principal Effects of a Reverse Stock Split

After the effective date of the reverse stock split, each stockholder would own a reduced number of shares of common stock. However, the reverse stock split would affect all stockholders uniformly and would not affect any stockholder’s percentage ownership interest in Advaxis (except to the extent that the reverse stock split would result in some of our stockholders owning a fractional share as described below). Proportionate voting rights and other rights and preferences of the holders of common stock would not be affected by the reverse stock split (except to the extent that the reverse stock split would result in some of our stockholders owning a fractional share as described below). For example, a holder of 2% of the voting power of the outstanding shares of common stock immediately prior to the reverse stock split would continue to hold approximately 2% of the voting power of the outstanding shares of common stock immediately after the reverse stock split. The number of stockholders of record also would not be affected by the reverse stock split (except to the extent that the reverse stock split would result in some of our stockholders owning only a fractional share as described below).

The following table contains approximate information relating to our common stock if (i) the reverse stock split is implemented at a ratio of one-for-ten and (ii) the reverse stock split is implemented at a ratio of one-for-fifteen based on share information as of close of business on December 26, 2018:

| As of December 26, 2018 | Shares Issued and Outstanding | Shares Authorized and Reserved for Issuance(1) | Shares Authorized and Unreserved | Total Authorized | ||||||||||||

| Pre-split | 69,619,886 | 20,258,103 | 5,122,011 | 95,000,000 | ||||||||||||

| If 1-for-10 reverse stock split enacted | 6,961,989 | 2,025,810 | 86,012,201 | 95,000,000 | ||||||||||||

| If 1-for-15 reverse stock split enacted | 4,641,326 | 1,350,540 | 89,008,134 | 95,000,000 | ||||||||||||

| If 1-for-25 reverse stock split enacted | 2,784,795 | 810,324 | 91,404,881 | 95,000,000 | ||||||||||||

(1) Shares that are authorized and reserved for issuance upon the exercise of outstanding options, warrants, and unvested restricted stock units.

Procedures for Effecting the Reverse Stock Split and Filing the Reverse Stock Split Amendment

If the stockholders approve the Reverse Stock Split Amendment and the Board subsequently determines that it is in the Company’s and the stockholders’ best interests to effect a reverse stock split, our Board will then determine the ratio of the reverse stock split to be implemented. Any such split will become effective upon the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware. The actual timing of any such filing will be made by the Board at such time as the Board believes to be most advantageous to the Company and its stockholders.

Fractional Shares

Stockholders will not receive fractional shares in connection with the reverse stock split. Instead, the Company’s transfer agent will aggregate all fractional shares collectively held by the Company’s stockholders into whole shares and arrange for them to be sold on the open market. Stockholders otherwise entitled to fractional shares will receive a cash payment in lieu thereof in an amount equal to the stockholder’s pro rata share of the total net proceeds of these sales. Stockholders will not be entitled to receive interest for the period of time between the effective date of the reverse stock split and the date the stockholder receives his or her cash payment. The proceeds will be subject to certain taxes as discussed below.

Stockholders holding fewer than one (1) post-reverse split share of the Company’s common stock will receive only cash in lieu of fractional shares and will no longer hold any shares of common stock as of the effective time of the Reverse Stock Split Amendment.

Effective Time and Implementation of the Reverse Stock Split

The effective time (the “Effective Time”) for the reverse stock split will be the date on which the Company files the Reverse Stock Split Amendment with the office of the Secretary of State of the State of Delaware or such later date and time as specified in the Reverse Stock Split Amendment as filed, provided that the Effective Time must be prior to the 2020 Annual Meeting.

Effect of Reverse Stock Split on Options

The number of shares subject to outstanding options to purchase shares of our common stock also would automatically be reduced in the same ratio as the reduction in the outstanding shares. Correspondingly, the per share exercise price of those options will be increased in direct proportion to the reverse stock split ratio, so that the aggregate dollar amount payable for the purchase of the shares subject to the options will remain unchanged. For example, assuming that an optionee holds options to purchase 100 shares at an exercise price of $1.25 per share, on the effectiveness of a 1-for-10 reverse stock split, the number of shares subject to that option would be reduced to 10 shares and the exercise price would be proportionately increased to $12.50 per share.

Effect of Reverse Stock Split on Warrants

The agreements governing the outstanding warrants to purchase shares of our common stock include provisions requiring adjustments to both the number of shares issuable upon exercise of such warrants, and the exercise prices of such warrants, in the event of a reverse stock split. For example, assuming that a warrant holder holds a warrant to purchase 1,000 shares of our common stock at an exercise price of $0.75 per share, on the effectiveness of a 1-for-10 reverse stock split, the number of shares subject to that warrant would be reduced to 100 shares and the exercise price would be proportionately increased to $7.50 per share.

| 10 |

Effect of Reverse Stock Split on Convertible Promissory Notes

The agreements governing any outstanding convertible promissory notes generally include provisions requiring adjustments to the number of shares issuable upon conversion, and the conversion price for such shares, in the event of a reverse stock split. For example, assuming that a note holder holds a promissory note convertible into 1,000 shares of our common stock at a conversion price of $0.75 per share, on the effectiveness of a 1-for-10 reverse stock split, the number of shares subject to that convertible promissory note would generally be reduced to 100 shares and the conversion price would be proportionately increased to $7.50 per share. However, convertible promissory notes that we may issue may be subject to specifically negotiated agreements and accordingly, the terms of the applicable specific agreement would govern any adjustments due to a reverse stock split.

Beneficial Holders of Common Stock

Upon the implementation of the reverse stock split, the Company intends to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding common stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the reverse stock split and making payment for fractional shares. Stockholders who hold shares of common stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered “Book-Entry” Holders of Common Stock

Certain registered holders of common stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic) to receive whole shares of post-reverse stock split common stock or payment in lieu of any fractional share interest, if applicable.

Holders of Certificated Shares of Common Stock

Stockholders holding shares of common stock in certificated form will be sent a transmittal letter by the transfer agent after the Effective Time. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing shares of common stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing the appropriate number of whole shares of post-reverse stock split common stock (the “New Certificates”). No New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Stockholders will receive a New Certificate(s) representing the number of whole shares of common stock that they are entitled to as a result of the reverse stock split. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of whole shares of post-reverse stock split common stock to which these stockholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates. If an Old Certificate has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends that are on the back of the Old Certificate(s). If a stockholder is entitled to a payment in lieu of any fractional share interest, such payment will be made as described above under “—Fractional Shares.”

Exchange of Pre-Reverse Stock Split Shares with Post-Reverse Stock Split Shares

If we implement a reverse stock split, we expect that our transfer agent will act as our exchange agent to act for holders of common stock in implementing the exchange of their pre-reverse stock split shares for post-reverse stock split shares.

Registered Book Entry Stockholder. Holders of common stock holding all of their shares electronically in book-entry form with the Company’s transfer agent do not need to take any action (the exchange will be automatic) to receive post-reverse stock split shares.

Registered Certificated Stockholder. Some of our stockholders hold their shares in certificate form or a combination of certificate and book-entry form. If any of your shares are held in certificate form, you will receive a transmittal letter from the Company’s transfer agent as soon as practicable after the effective date of the reverse stock split. The letter of transmittal will contain instructions on how to surrender your certificate(s) representing your pre-reverse stock split shares to the transfer agent. Upon receipt of your pre-reverse stock split certificate(s), you will be issued the appropriate number of shares electronically in book-entry form under the Direct Registration System (“DRS”). No new shares in book-entry form will be reflected until you surrender your outstanding pre-reverse stock split certificate(s), together with the properly completed and executed letter of transmittal, to the transfer agent. At any time after receipt of your DRS statement, you may request a stock certificate representing your ownership interest.

Accounting Matters

The reverse stock split will not affect the par value of a share of the Company’s common stock. The Company’s capital account would remain unchanged. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding. We do not anticipate that any other accounting consequences would arise as a result of the reverse stock split.

Potential Anti-Takeover Effect; Possible Dilution

The increase in the number of unissued authorized shares available to be issued could, under certain circumstances, have an anti-takeover effect. For example, shares could be issued that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board of Directors or contemplating a tender offer or other transaction for the combination of the Company with another company. The reverse stock split is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of our company, nor is it part of a plan by management to recommend a series of similar amendments to our Board of Directors and stockholders.

The holders of our common stock do not have preemptive rights to subscribe for additional securities that may be issued by the Company, which means that current stockholders do not have a prior right to purchase any additional shares from time to time issued by the Company. Accordingly, if our Board of Directors elects to issue additional shares of common stock, such issuance could have a dilutive effect on the earnings per share, voting power and equity ownership of current stockholders.

No Appraisal Rights

Under the Delaware General Corporation Law, the Company’s stockholders are not entitled to appraisal rights with respect to the reverse stock split.

U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of important U.S. federal income tax considerations of the reverse stock split. Such summary addresses only individual U.S. stockholders who hold our common stock as capital assets. Moreover, such summary does not purport to be complete and does not address stockholders subject to special rules, such as dealer in securities or currencies; financial institutions; regulated investment companies; real estate investment trusts; insurance companies; tax-exempt organizations; persons holding our common stock as part of a straddle, hedge or conversion transaction; traders in securities that have elected the mark-to-market method of accounting with respect to our common stock; partnerships or other pass-through entities for U.S. federal income tax purposes; persons whose “functional currency” is not the U.S. dollar; foreign stockholders; U.S. expatriates; or stockholders who acquired their pre-reverse stock split common stock pursuant to the exercise of employee stock options or otherwise as compensation. Further, it does not address any state, local, estate or foreign income or other tax consequences. This summary is based upon provisions of the Internal Revenue Code of 1986, as amended (the “Code”), and Treasury regulations, rulings and judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, so as to result in U.S. federal income tax consequences different from those summarized below. No ruling from the Internal Revenue Service or opinion of counsel will be obtained regarding the U.S. federal income tax consequences to stockholders as a result of the reverse stock split. The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder.

Accordingly, stockholders are advised to consult their own tax advisors for more detailed information regarding the effects of the proposed reverse stock split on them under applicable U.S. federal, state, estate, local and foreign tax laws.

We believe that the material U.S. federal income tax consequences of the proposed reverse stock split would be as follows:

The proposed reverse stock split is intended to be treated as a “reorganization” within the meaning of Section 368 of the Code. Assuming that such reverse stock split qualifies as a reorganization, a stockholder generally will not recognize gain or loss on the reverse stock split. The aggregate tax basis of the post-reverse stock split common stock received will be equal to the aggregate tax basis of the pre-reverse stock split common stock exchanged therefor (excluding any portion of the holder’s basis allocated to fractional shares), and the holding period of the post-reverse stock split common stock received will include the holding period of the pre-reverse stock split common stock exchanged. No gain or loss will be recognized by us as a result of the reverse stock split.

Stockholders who receive cash for all of their holdings (as a result of owning fewer than one (1) share of our common stock, post split) and who are not related to any person or entity that holds common stock immediately after the reverse stock split, generally should recognize a gain or loss for U.S. federal income tax purposes equal to the difference between the cash received and their basis in the pre-reverse split common stock. Such gain or loss generally would be a capital gain or loss and generally would be a long-term gain or loss to the extent that the stockholder’s holding period exceeds 12 months. Stockholders who receive cash for fractional shares generally should be treated for U.S. federal income tax purposes as having sold their fractional shares and generally should recognize gain or loss in an amount equal to the difference between the cash received and the portion of their basis for the pre-reverse stock split common stock allocated to the fractional shares. Similarly, such gain or loss generally should be capital gain or loss and generally would be a long-term gain or loss to the extent that the stockholder’s holding period exceeds 12 months.

Board Discretion to Implement the Reverse Stock Split

If the proposed reverse stock split is approved at the Annual Meeting, our Board of Directors may, in its sole discretion, at any time prior to the 2020 Annual Meeting, determine the ratio for the split based on the parameters in this Proposal No. 3, and authorize the filing of the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware. Notwithstanding the approval of the form of the Reverse Stock Split Amendment at the Annual Meeting, our Board of Directors may, in its sole discretion, determine not to implement the reverse stock split.

Vote Required

To approve Proposal No. 3, stockholders holding a majority of the outstanding shares of Advaxis common stock must vote FOR Proposal No. 3. “Broker non-votes” shall be counted as votes FOR Proposal No. 3, while abstentions will count as a vote AGAINST Proposal No. 3.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 3 RELATING TO THE AMENDMENT OF OUR

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT

| 13 |

ADVISORY (NON-BINDING) RESOLUTION REGARDING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and Section 14A of the Securities Exchange Act of 1934, as amended, or the Exchange Act, our stockholders are entitled to vote to approve, on an advisory (nonbinding) basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement in accordance with the Securities and Exchange Commission’s rules.

Our executive compensation programs are designed to retain and incentivize the high quality executives whose efforts are key to our long-term success. Under these programs, our Named Executive Officers are rewarded on the basis of individual and corporate performance measured against established corporate and strategic goals. Please read the section of this Proxy Statement under the heading “Compensation of Officers and Directors” for additional details about our executive compensation programs, including information about the fiscal year 2018 compensation of our Named Executive Officers.

The Compensation Committee of our Board of Directors continually reviews the compensation programs for our Named Executive Officers to ensure they achieve the desired goals of aligning our executive compensation structure with our stockholders’ interests and current market practices.

We are asking our stockholders to indicate their support for our Named Executive Officer compensation as described in this proxy statement. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our Named Executive Officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our Named Executive Officers and the philosophy, policies and practices described in this Proxy Statement. Accordingly, we are asking our stockholders to cast a non-binding advisory vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the stockholders of Advaxis, Inc. approve, on an advisory basis, the compensation of the named executive officers, as disclosed in Advaxis, Inc.’s Proxy Statement for the 2019 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the summary compensation table and the other related tables and disclosure.”

The say-on-pay vote is advisory, and therefore not binding on Advaxis, the Compensation Committee or our Board of Directors. Nevertheless, our Board of Directors and our Compensation Committee value the opinions of our stockholders, whether expressed through this vote or otherwise, and accordingly, the Board and Compensation Committee intend to consider the results of this vote among the many factors they consider in making determinations in the future regarding executive compensation arrangements.

Vote Required

Stockholder approval of this Proposal No. 4 will require the affirmative vote of the holders of a majority of the votes cast in person or by proxy at the Annual Meeting. Abstentions will have the same effect as votes AGAINST Proposal No. 4. Broker non-votes will not affect the outcome of the vote on Proposal No. 4.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”FOR PROPOSAL

NO. 4 RELATING TO THE APPROVAL OF THE AMENDMENT OF OUR AMENDED AND RESTATED CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK BY 30,000,000 SHARES FROM 65,000,000 TO 95,000,000.ADVISORY VOTE ON EXECUTIVE COMPENSATION

| 14 |

ADVISORY (NON-BINDING) VOTE ON THE FREQUENCY AT WHICH WE SHOULD INCLUDE

AN ADVISORY VOTE REGARDING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

APPROVAL OF THE ADVAXIS, INC. 2018

EMPLOYEE STOCK PURCHASE PLANBackground

WeAs described in Proposal No. 4 above, stockholders are seekingbeing provided the opportunity to cast an advisory vote on our executive compensation program, commonly referred to as a “say-on-pay vote.” The Dodd-Frank Act also enables our stockholders to indicate their preference regarding how frequently we should solicit a non-binding advisory “say-on-pay” vote on the compensation of our named executive officers as disclosed in our Proxy Statements. This Proposal No. 5 is commonly known as a “say-on-frequency” proposal. Accordingly, we are asking stockholders to indicate whether they would prefer an advisory vote every one year, every two years or every three years. Alternatively, stockholders may abstain from casting a vote.

For the reasons described below, our Board recommends that our stockholders select a frequency of three years, or a triennial vote. Our Board has determined that an advisory vote on executive compensation every three years is the best approach for us based on a number of considerations, including the following:

| ● | Our compensation program does not change significantly from year to year and is designed to induce performance over a multi-year period. A vote held every three years would be more consistent with, and provide better input on, our long-term compensation, which constitutes a significant portion of the compensation of our named executive officers; | |

| ● | A three-year vote cycle gives our Board and the Compensation Committee sufficient time to thoughtfully consider the results of the advisory vote, to engage with stockholders to understand and respond to the vote results and effectively implement any appropriate changes to our executive compensation policies and procedures; and | |

| ● | A three-year period between votes will give stockholders sufficient time to evaluate the effectiveness of our short-term and long-term compensation strategies and the related business outcomes of the company, and whether the components of the compensation paid to our named executive officers have achieved positive results for the company. |

Our stockholders also have the opportunity to provide additional feedback on important matters involving executive compensation even in the years when say-on-pay votes do not occur. For example, the rules of the Nasdaq Stock Market require that we seek stockholder approval of the Advaxis, Inc. 2018 Employee Stock Purchase Plan (the “Employee Stock Purchase Plan”), which was approvedfor new employee equity compensation plans and material revisions thereto. Further, as discussed above under “Communications by the Board ofStockholders with Directors, on January 23, 2018, subject to approval by the” we provide stockholders at the Annual Meeting. If approved by the stockholders, the Plan will be effective as of the date of the Annual Meeting.

The purpose of the Employee Stock Purchase Plan is to provide eligible employees of the Company and certain of its subsidiarieswith an opportunity to use payroll deductionscommunicate directly with our Board, including on issues of executive compensation.

You may cast your vote on your preferred voting frequency by choosing the option of three years, two years, one year, or abstain from voting when you vote in response to purchase sharesthe resolution set forth below:

“RESOLVED, that the stockholders of Advaxis, Inc. (the “Company”) hereby approve, on an advisory basis, that the frequency with which they prefer to have a Say-on-Pay vote is:

| ● | Every three years; | |

| ● | Every two years; | |

| ● | Every year; or | |

| ● | Abstain from voting. |

You are not voting to approve or disapprove our Board’s recommendation. While this advisory say-on-frequency vote is non-binding, and we may hold say-on-pay votes more or less frequently than the preference receiving the highest number of votes of our common stockstockholders, our Board and thereby acquire an ownership interest in the Company. The Employee Stock Purchase Plan is intended to qualify as an “employee stock purchase plan” meeting the requirements of Section 423 of the Internal Revenue Code.

The maximum aggregate number of shares of our common stock that may be purchased under the ESPPCompensation Committee will be 1,000,000. As of January 19, 2018, there were approximately 108 employees eligible to participate in the Employee Stock Purchase Plan.

A summary of the Employee Stock Purchase Plan is set forth below. The summary is qualified in its entirety by referencegive careful consideration to the full textchoice that receives the most votes when considering the frequency of the plan, which is filed with this Proxy Statement asExhibit B.

Summary of the Planfuture say-on-pay votes.

AdministrationVote Required

SubjectGenerally, approval of any matter presented to the express provisionsstockholders is determined by a majority of the Employee Stock Purchase Plan,votes cast affirmatively or negatively on the matter, assuming a quorum is present. However, given that Proposal No. 5 is advisory and non-binding, if none of the frequency options receive a majority of the votes cast, the option receiving the greatest number of votes will be considered the frequency recommended by the stockholders. In such instance, while none of the three alternatives will have been approved, stockholders will still have the ability to communicate their preference with respect to this vote.

This vote is advisory and therefore not binding on the Company or the Board. The Board and the Compensation Committee, however, will review the voting results and take them into account in making decisions regarding the frequency of our Board has authority to interpret and construestockholder votes on the provisionscompensation of the Employee Stock Purchase Plan, to adopt rules and regulations for administering the Employee Stock Purchase Plan, and to make all other determinations necessary or advisable for administering the Employee Stock Purchase Plan. The Employee Stock Purchase Plan will be administered in order to qualify as an employee stock purchase plan under Section 423 of the Internal Revenue Code.executive officers.

Stock Subject to the PlanOUR BOARD UNANIMOUSLY RECOMMENDS THAT AN ADVISORY

Subject to adjustment as provided in the Employee Stock Purchase Plan, the aggregate number of shares of Common Stock reserved and available for issuance pursuant to the Employee Stock Purchase Plan is 1,000,000. As of January 19, 2018, the closing price of our common stock on NASDAQ was $2.93 per share.

VOTE REGARDING THE COMPENSATION OF OUR NAMED EXECUTIVE

Eligibility; Grant and Exercise of OptionsOFFICERS BE INCLUDED IN THE COMPANY’S PROXY STATEMENT

All employees of the Company are eligible to participate in the Employee Stock Purchase Plan as of the second offering period following their most recent date of hire.

No employee may be granted options to purchase shares of our common stock under the Employee Stock Purchase Plan if such employee (i) immediately after the grant would own capital stock possessing 5% or more of the total combined voting power or value of all classes of our capital stock, or (ii) holds rights to purchase shares of our common stock under all of our employee stock purchase plans (as defined in Section 423 of the Internal Revenue Code) that accrue at a rate that exceeds $25,000 worth of shares of our common stock for each calendar year.

Plan Provisions

The Employee Stock Purchase Plan provides for monthly offering periods coinciding with each calendar month, unless specified otherwise by the committee. Eligible employees may elect to become a participant in the Employee Stock Purchase by submitting a request form to the administrator, which will remain effective from offering period to offering period unless and until the participant files a new request form. Participants may contribute between 1% and 20%, in whole percentages, of his or her gross base pay, provided, however, that a participant may not purchase more than 1,000 shares of our common stock during each offering period, subject to adjustment as provided in the Plan. Payroll deductions will accumulate in a non-interest bearing contribution account. All deductions are made on an after tax basis.

On the first day of an offering, participants will be granted an option to purchase on the last day of the offering (the “purchase date”) at the price described below (the “purchase price”) the number of full shares of common stock which the cash credited to his or her contribution account on the purchase date will purchase at the purchase price. Unless a participant terminates employment or withdraws from the Plan or an offering on or before the purchase date, his or her option to purchase shares of common stock will be deemed to have been exercised automatically on the purchase date. The purchase price will be 85% of the fair market value of the common stock on the purchase date of the offering. No brokerage fees will be charged for these purchase transactions. If there is a cash balance remaining in a participant’s contribution account at the end of an offering representing the exercise price for a fractional share of common stock, such balance will remain in the contribution account to be used in the next offering, unless he or she requests that such amount be refunded. All shares purchased will be held in the participant’s name by the administrator.

Options granted under the Plan are not transferable other than by will or by the laws of descent and distribution and options are exercisable only by the participant during his or her lifetime.

FOR STOCKHOLDER CONSIDERATION EVERY THREE CALENDAR YEARS.

Termination of Employment and Withdrawal from the Plan

If a participant’s employment is terminated for any reason, his or her participation in the Plan will terminate immediately and the balance, if any, in his or her contribution account will be returned in cash, without interest.

Participants may elect to withdraw from the Employee Stock Purchase Plan at any time and receive back any of their contributions, without interest, not used to purchase shares. If a participant wishes to withdraw his or her funds prior to a purchase, he or she must make an election to do so 15 days prior to the end of the offering period. If a participant does withdraw, he or she will not be eligible to re-enroll until the beginning of the 2nd subsequent offering period (i.e. the participant may not participate in the offering period following the one from which he or she just withdrew).

Amendment and Termination of the Plan

The Compensation Committee may amend the Employee Stock Purchase Plan at any time; provided, however, that no amendment may, without stockholder approval, materially affect the eligibility requirements under the Employee Stock Purchase Plan or increase the number of shares of common stock subject to any options issued to participants.

The Compensation Committee may terminate the Employee Stock Purchase Plan at any time. Upon termination of the Employee Stock Purchase Plan, the administrator must give notice thereof to participants and will terminate all payroll deductions. Cash balances then credited to participants’ contribution accounts will be distributed as soon as practicable, without interest.

Federal Income Tax Consequences to the Company and to Participants

The Employee Stock Purchase Plan is designed to qualify as an Employee Stock Purchase Plan under Section 423 of the Code. A general summary of the federal income tax consequences regarding the Employee Stock Purchase Plan is stated below. The tax consequences of participating in the Employee Stock Purchase Plan may vary with respect to individual situations. Accordingly, participants should consult with their tax advisors in regard to the tax consequences of participating in the Employee Stock Purchase Plan as to both federal and state income tax considerations.